401k calculator with over 50 catch up

First all contributions and earnings to your 401 k are tax deferred. The Roth 401 k was first available in 2001.

401k Limits 2022 What To Keep In Mind Acorns

The annual elective deferral limit for a 401k plan in 2022 is 20500.

. For those age 50 and older the 401 k catch-up contribution is 6500. Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. Ad A Rule of Thumb Is That Youll Need 10 Times Your Income at Retirement.

A Retirement Calculator To Help You Plan For The Future. If youre 50 or older and need to catch up on your 401 k retirement savings the total amount youre able. First all contributions and earnings to your 401 k are tax deferred.

According to the IRS he can contribute 6000 for 401k catch. If you are 50 years of age or older and are already contributing the. It provides you with two important advantages.

A 401 k can be one of your best tools for creating a secure retirement. If you want to know how much you can put aside for. Of this 20500 is the standard contribution limit that applies to everyone and.

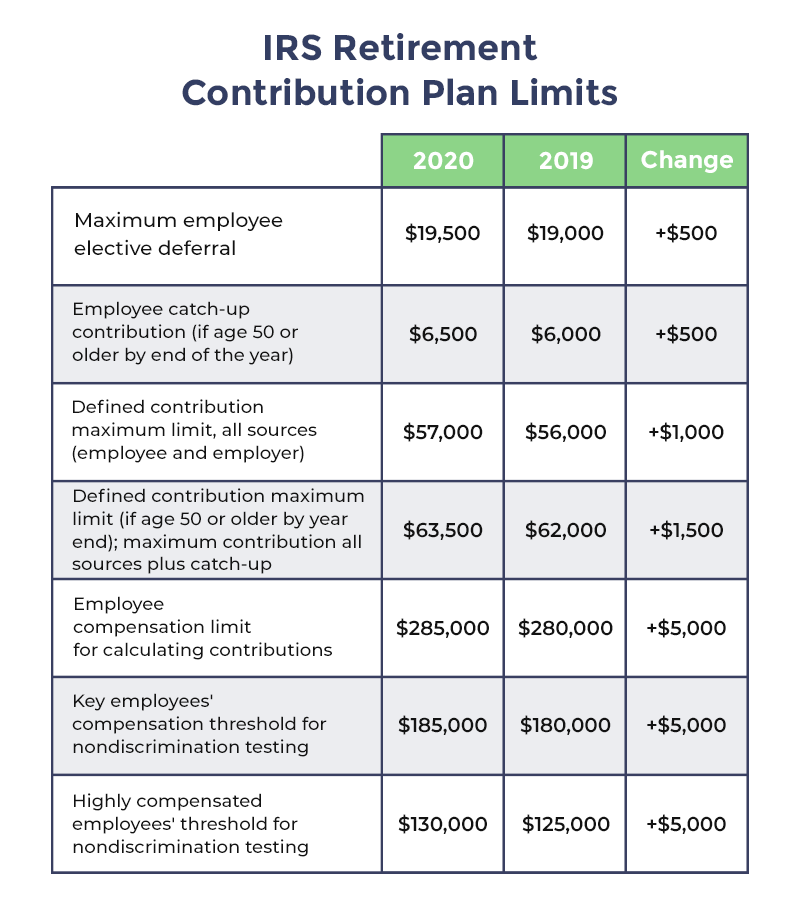

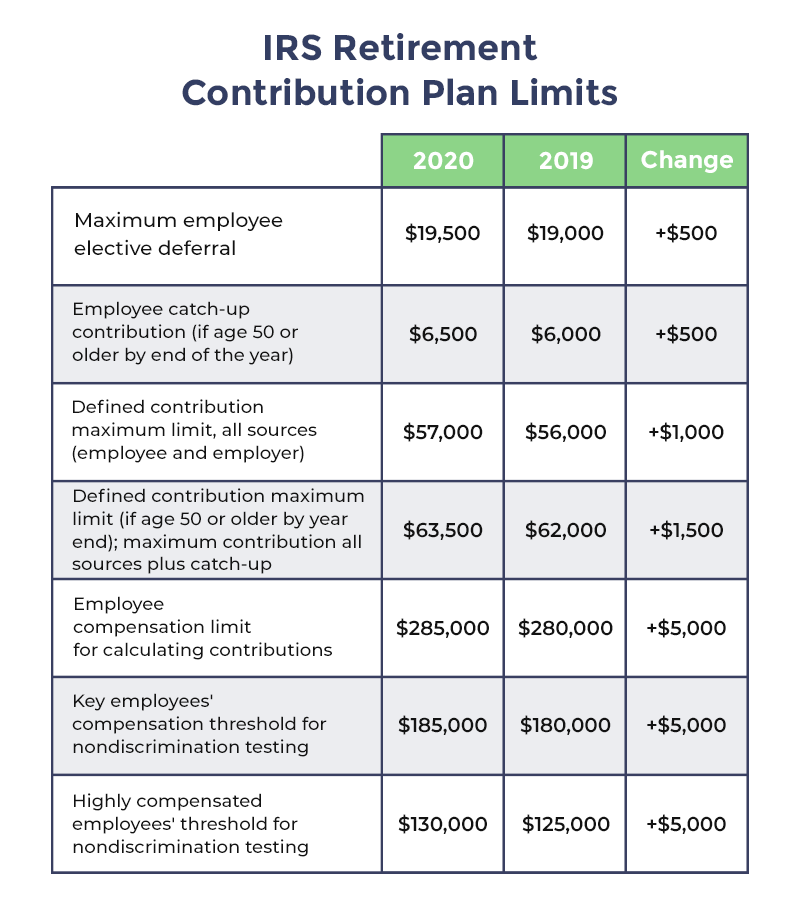

For those age 50 or over who are making catch-up contributions the limits are 26000 in 2020 an additional 6500. The maximum you can contribute to a 401 k is 20500 in 2022. Ad Build Your Future With A Firm That Has 85 Years Of Investing Experience.

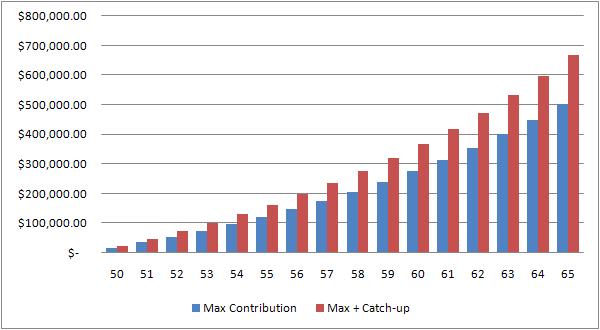

Individuals who are age 50 or over at the end of the calendar year can make annual catch-up contributions. It provides you with two important advantages. You may now make an additional pre-tax contribution to your plan if you reach age 50 during the calendar year and have reached either the plans or the IRS pre-tax contribution limit.

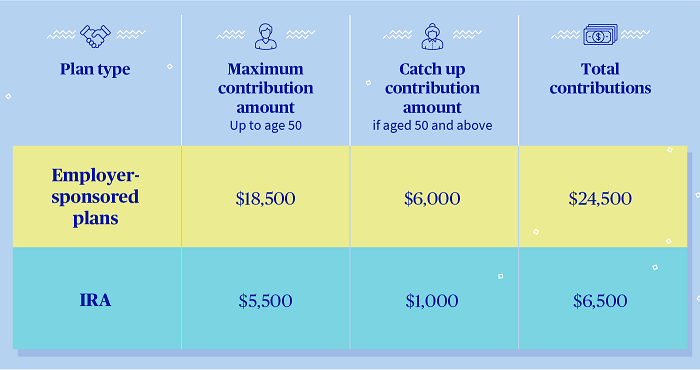

A Roth IRA offers more investment options and. The annual 401k contribution limit is 20500 for tax year 2022 with an extra 6500 allowed as a catch-up contribution every year for participants age 50 or older. Ad Build Your Future With A Firm That Has 85 Years Of Investing Experience.

The catch-up contribution limit is 6500 in 2022. A 401 k can be one of your best tools for creating a secure retirement. The catch-up contribution limit is 6500 in 2022 for people age 50 or older.

Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. The 401k plan annual contribution limit is 20500 while the catch up contribution is 6500. However employees 50 and older can make an annual catch-up contribution of 6500 bringing their total limit to 27000.

Catch-up contributions for workers 50 and older. This means that if you are 50 or over you can contribute a total of 27000 per year. Protect Yourself From Inflation.

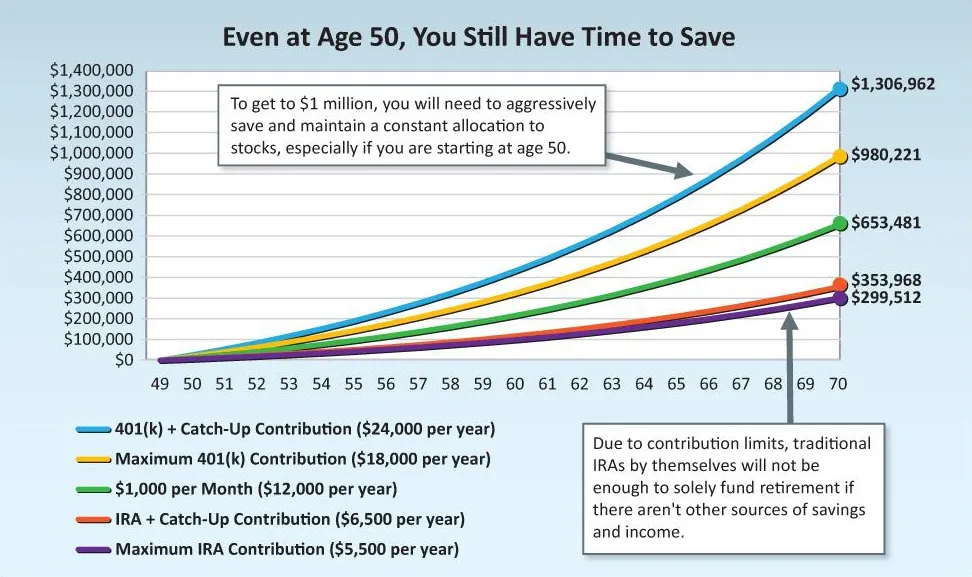

Account values for the next 20 years. Catch-up contributions can help you do just that. Get to your destination by making sure your retirement tank is full.

A participant who is eligible to make catch-up contribution is referred to as catch-up eligible participant A participant is catch-up eligible with respect to a plan year if he or she. Annual catch-up contributions up to 6500 in 2022 6500 in 2021. Therefore participants in 401k 403b most 457 plans and the federal governments Thrift Savings Plan who are 50 and older can contribute up to 27000 starting in.

Ad 10 Best Companies to Rollover Your 401K into a Gold IRA. Catch-up contributions can help you do just that. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

A Roth 401 k has higher contribution limits and lets employers match contributions. Total contribution limit plus catch-up. The Internal Revenue Service allows individuals who are age 50 or older by the end of the calendar year to make extra pre-tax contributions to their work-sponsored retirement.

In 2022 the maximum annual 401 k contribution limit for those age 50 or older was 27000. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity.

Top 9 Reasons To Make 401 K Catch Up Contributions Bankrate

Retirement Services 401 K Calculator

The Big List Of 401k Faqs For 2020 Workest

What Is 401k Catch Up Contribution Sofi

Catch Up Contributions Definition Amounts How To Make Them Bankrate

Understanding The Mega Backdoor Roth Ira

Ira 401k Contributions Catch Up Infographic Blackrock Investing For Retirement Budgeting Finances Saving For Retirement

How To Take Advantage Of 401 K Catch Up Contributions Wtop News

401k Catch Up Contributions Retirement Catch Up Limits

5 Reasons A 401 K Is Better Than A Simple Ira

How Much Can I Contribute To My Self Employed 401k Plan

Catch Up Contributions How Do They Work Principal

Solo 401k Contribution Limits And Types

How To Catch Up In Your Retirement Savings Plans Equitable

Retirement You Can Save 1 Million Even Starting At Age 50 Money

Solo 401k Calculating My Solo 401k Contributions For A Sole Proprietor My Solo 401k Financial

Retirement Tips Money Saving Tips Budgeting Money Money Management