30+ mortgage deduction calculator

Web To determine what type of mortgage works better for you and compare your total costs simply plug in the total cost of the home your expected down payment. Web A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price down payment interest rate and.

How To Read A Paycheck Britannica Money

Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

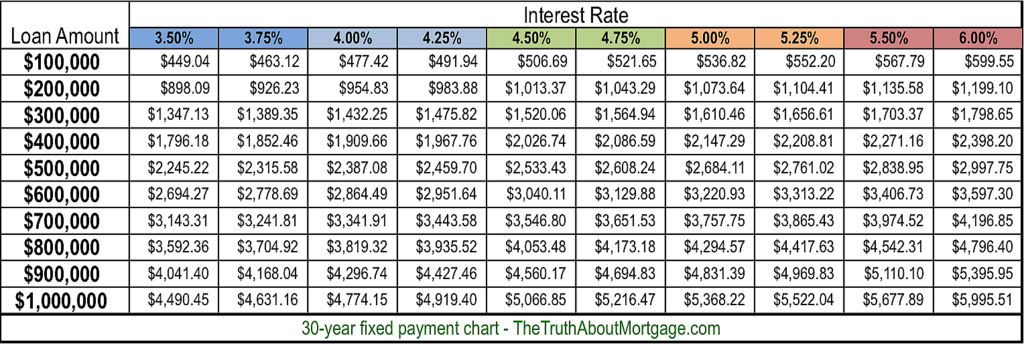

. Ad See how much house you can afford. However higher limitations 1. Web 59 rows If you take out a 30-year fixed rate mortgage this means.

Gross income the sum of all the money you. Ad See what your estimated monthly payment would be with the VA Loan. How a mortgage calculator helps you Determining.

Check Official Requirements See If You Qualify for a 0 Down VA Home Loan. Web Mortgage Calculator Use Zillows home loan calculator to quickly estimate your total mortgage payment including principal and interest plus estimates for PMI property. Web You can calculate your AGI for the year using the following formula.

The standard deduction is 19400 for those filing as head. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

N 30 years x 12 months per year or 360 payments. Estimate your monthly mortgage payment. Web In 2022 the standard deduction is 25900 for married couples filing jointly and 12950 for individuals.

Ad Start Using Our Online Mortgage Calculators To Calculate Your Monthly Payment. Web The mortgage interest deduction is a key tax provision that allows millions of homeowners to offset the mortgage interest paid each year against taxable income. AGI gross income adjustments to income.

You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent for a loan term of 30 years heres what you will get to write off as a. Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which is.

Web Home mortgage interest.

Buying A Home If I Want To Purchase A House Should I Be Using My Gross Income Or Net Income To Determine What I Can Afford Quora

How Much Home Can You Afford Www Hudhomenetwork Com

4 Steps To Claim Interest On Home Loan Deduction Rr Housing India Pvt Ltd

Income Tax Calculator Find Out Your Take Home Pay Mse

It S Time To Gut The Mortgage Interest Deduction

30 Tax Tips From The Tax Pros

How To Calculate Your Fire Number When You Have A Mortgage With Spreadsheet R Financialindependence

How The Big 6 Tax Plan Would Downsize The Mortgage Interest Deduction

How To Calculate A Staff Housing Loan In A Simple Interest Rate Formula Quora

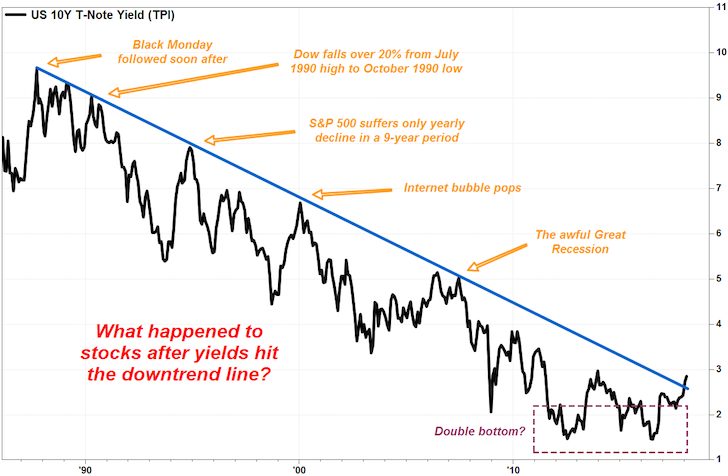

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage

Free 9 Mortgage Payment Calculator Templates In Pdf

Mortgage Payment Calculator With Taxes And Insurance

Income Tax Calculator Find Out Your Take Home Pay Mse

What Is Gross Pay Gocardless

Calculate Mortgage Rates With The Mortgage Calculator Mortgage Payment Calculator Mortgage Amortization Calculator Mortgage Loan Calculator

Home Mortgage Interest Deduction Calculator

Home Mortgage Loan Interest Payments Points Deduction